Learning how to create a monthly budget that actually works in 2026 is no longer just about tracking expenses. Rising living costs, subscription overload, digital payments, and new income models have changed how people manage money. A modern budget must be flexible, realistic, and aligned with your lifestyle.

Whether you are a student, employee, freelancer, or building an online business, this guide will walk you step by step through creating a monthly budget you can stick to—without feeling restricted or overwhelmed.

Why Traditional Budgets Fail in 2026

Many people give up on budgeting because traditional methods feel outdated. Fixed-category spreadsheets often ignore real-world behavior and unexpected expenses.

Common reasons budgets fail include:

- Unrealistic spending limits

- Ignoring irregular expenses

- Not accounting for variable income

- Lack of automation

- No connection to financial goals

To understand how to create a monthly budget that actually works in 2026, you must first accept that budgeting is a dynamic system, not a rigid rulebook.

Step 1: Define Your Financial Goals First

A budget without a purpose will not last. Start by defining what you want your money to achieve.

Short-Term Goals

These may include paying off credit cards, building an emergency fund, or covering upcoming travel expenses.

Long-Term Goals

Long-term goals could involve investing, saving for a home, or building passive income streams through affiliate marketing or other digital ventures.

When your budget supports your goals, every spending decision feels intentional rather than restrictive.

Step 2: Track Your Real Spending Patterns

Before creating categories, review your actual spending from the past two to three months.

Use banking apps, budgeting tools, or spreadsheets to analyze:

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (food, transport, entertainment)

- Digital subscriptions

- Impulse or lifestyle spending

This step reveals where your money truly goes, which is essential when learning how to create a monthly budget that actually works in 2026.

Step 3: Use the 60–30–10 Budget Framework (Modern Version)

Instead of outdated rules, a modern budget framework works better in 2026.

- 60% for essentials and flexible living costs

- 30% for financial growth and savings

- 10% for guilt-free spending

This structure adapts well to people with side hustles, freelance income, or a dropshipping business.

Learn more about budgeting frameworks from this external resource:

Investopedia’s budgeting guide.

Step 4: Automate Your Budget Wherever Possible

Automation is a game changer. The more decisions you remove, the more consistent your budget becomes.

Automate:

- Bill payments

- Savings transfers

- Investment contributions

- Emergency fund deposits

Automation ensures progress even during busy or stressful months.

Step 5: Build a Buffer for Irregular Expenses

One reason budgets fail is unexpected costs. These include annual subscriptions, medical bills, gifts, and repairs.

Create a “future expenses” category and contribute monthly. This prevents financial shocks and keeps your budget intact.

This strategy is essential if you are managing variable income from affiliate vs dropshipping models or freelance work.

Step 6: Budget for Income Growth, Not Just Expenses

Modern budgeting focuses on increasing income alongside controlling spending.

Consider allocating part of your budget to:

- Learning new skills

- Starting an online business

- Testing affiliate marketing platforms

- Scaling a dropshipping business

Unlike traditional budgets, this approach helps you grow financially instead of only cutting costs.

Step 7: Make Your Budget Flexible and Review Monthly

A working budget evolves. At the end of each month, review:

- What worked

- What felt restrictive

- Unexpected expenses

- Income changes

Adjust categories instead of abandoning the system. Flexibility is the secret behind how to create a monthly budget that actually works in 2026.

Common Budgeting Mistakes to Avoid

Even strong budgets can fail due to common errors.

- Being too strict

- Ignoring fun spending

- Not tracking small expenses

- Failing to update income changes

A sustainable budget supports your lifestyle rather than punishing it.

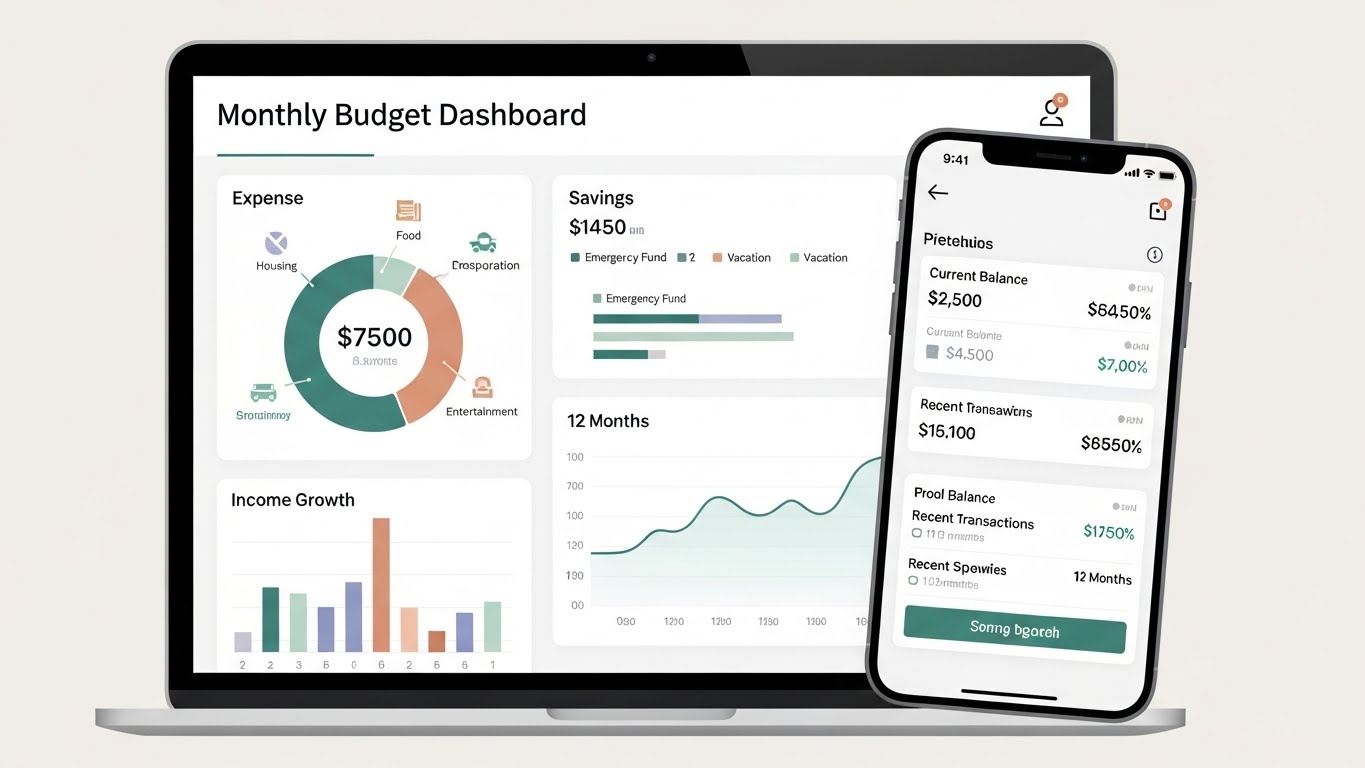

Tools That Make Budgeting Easier in 2026

Using the right tools simplifies budgeting and improves consistency.

Popular options include:

- Bank-integrated budgeting apps

- Spreadsheet templates

- AI-powered finance tools

You can also explore our internal guide on building financial systems:

How to Build Passive Income Online.

How Budgeting Supports Long-Term Wealth

A working budget is the foundation for wealth creation. It allows you to:

- Invest consistently

- Reduce financial stress

- Fund passive income projects

- Scale digital income streams

Over time, budgeting shifts from restriction to empowerment.

Final Thoughts

Understanding how to create a monthly budget that actually works in 2026 requires a mindset shift. Budgets are no longer about saying no to everything. They are about aligning money with goals, automating decisions, and staying flexible.

Start simple, adjust monthly, and focus on progress rather than perfection. A budget that works is one you can maintain—month after month.