How to improve gut health for better immunity and mental clarity is a question more people are asking as science continues to uncover the powerful connection between the gut, the immune system, and the brain. Your gut is not just responsible for digestion. It plays a central role in protecting you from illness, regulating inflammation, and even shaping your mood, focus, and mental resilience.

In this in-depth guide, you will learn practical, evidence-based strategies to support gut health naturally. These steps can help strengthen your immune defenses, sharpen mental clarity, and support long-term wellbeing.

Understanding the Gut–Immune–Brain Connection

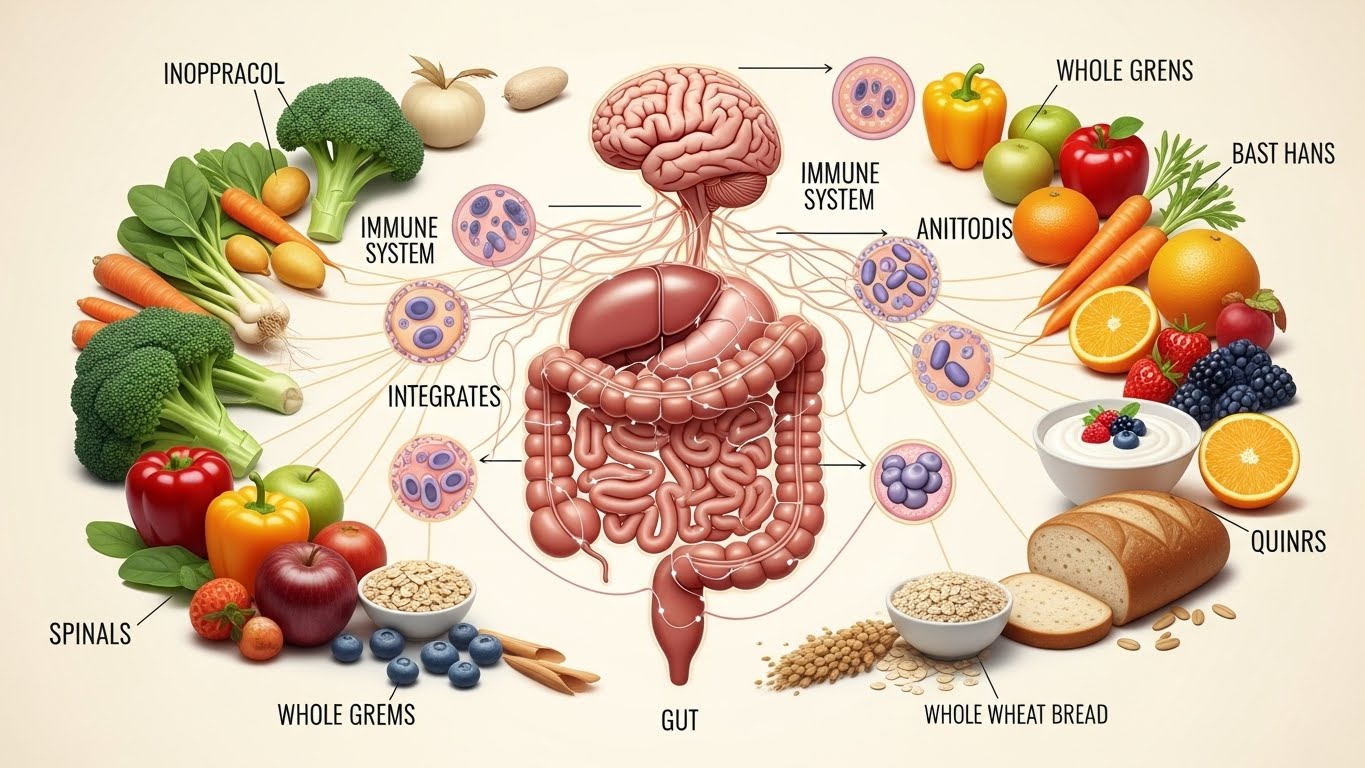

The gut contains trillions of microorganisms known as the gut microbiome. These bacteria, viruses, and fungi work together to digest food, produce essential nutrients, and defend against harmful pathogens.

Over 70% of immune cells are located in the gut. At the same time, the gut communicates directly with the brain through the gut–brain axis. This connection explains why gut imbalance can lead to frequent infections, brain fog, anxiety, and low mood.

Learning how to improve gut health for better immunity and mental clarity starts with understanding that gut balance affects your entire body.

Signs Your Gut Health May Be Poor

Gut imbalance, also called dysbiosis, often shows up in subtle ways. Common signs include:

- Frequent colds or infections

- Bloating, gas, or irregular bowel movements

- Food sensitivities

- Brain fog and poor concentration

- Low mood or anxiety

- Chronic fatigue

If these symptoms sound familiar, improving gut health may significantly improve both immunity and mental clarity.

Eat a Diverse, Fiber-Rich Diet

Diet is the foundation of gut health. Beneficial gut bacteria thrive on dietary fiber, especially prebiotic fibers found in plant foods.

Best Foods for Gut Health

Include a wide variety of the following foods daily:

- Vegetables such as broccoli, spinach, carrots, and onions

- Fruits like berries, apples, and bananas

- Whole grains including oats, brown rice, and quinoa

- Legumes such as lentils and chickpeas

- Nuts and seeds

A diverse diet encourages microbial diversity, which is strongly linked to better immune regulation and improved cognitive performance.

For more nutrition guidance, you can explore evidence-based resources like

this guide on prebiotic foods.

Include Fermented Foods Regularly

Fermented foods contain live probiotics that can directly enhance the gut microbiome.

Examples of Fermented Foods

- Yogurt with live cultures

- Kefir

- Sauerkraut

- Kimchi

- Miso

Consuming fermented foods has been associated with reduced inflammation, improved immune response, and better stress resilience.

Limit Ultra-Processed and Sugary Foods

Ultra-processed foods and excess sugar feed harmful bacteria while suppressing beneficial strains. This imbalance can weaken immune defenses and increase inflammation, which negatively affects brain function.

Reducing sugary drinks, packaged snacks, and refined carbohydrates is a key step in how to improve gut health for better immunity and mental clarity.

Support Gut Health with Proper Hydration

Water is essential for digestion and maintaining the protective mucus lining of the intestines. Dehydration can slow digestion and disrupt gut balance.

Aim to drink water consistently throughout the day. Herbal teas and water-rich foods also contribute to hydration.

Manage Stress to Protect the Gut

Chronic stress alters gut bacteria composition and increases intestinal permeability, often referred to as “leaky gut.” This can trigger immune overactivation and cognitive symptoms such as brain fog.

Effective Stress-Reduction Strategies

- Mindfulness or meditation

- Regular physical activity

- Breathing exercises

- Consistent sleep routines

Improving stress management not only benefits mental clarity but also creates a healthier environment for gut bacteria.

Prioritize High-Quality Sleep

Sleep deprivation disrupts gut microbial rhythms and weakens immune defenses. Poor sleep is also linked to impaired concentration and mood instability.

Establishing a consistent sleep schedule and reducing screen time before bed can significantly improve gut-brain communication.

Exercise Regularly, but Avoid Overtraining

Moderate exercise increases microbial diversity and supports immune regulation. Activities such as walking, cycling, and strength training are particularly beneficial.

However, excessive intense exercise without adequate recovery may stress the gut. Balance is essential for sustainable health improvements.

Consider Probiotics and Supplements Carefully

Probiotic supplements may help in certain situations, such as after antibiotic use. However, they are not a substitute for a healthy diet.

Consult a healthcare professional before starting supplements, especially if you have underlying conditions.

The Role of Gut Health in Productivity and Lifestyle Goals

Better gut health does not only improve immunity and mental clarity. It also enhances energy levels, focus, and consistency, which are critical for modern work and lifestyle goals.

Whether you are building an online business, exploring affiliate marketing, or creating passive income streams, mental clarity and resilience are essential. Many people comparing affiliate vs dropshipping underestimate the importance of health in sustaining long-term performance.

Running a dropshipping business or any digital venture requires focus, stress tolerance, and consistent decision-making. Supporting gut health can indirectly improve productivity and reduce burnout.

Long-Term Habits for a Healthy Gut

Gut health is not built overnight. Sustainable improvements come from consistent habits:

- Eat a varied, whole-food diet

- Stay physically active

- Manage stress proactively

- Sleep adequately

- Avoid unnecessary antibiotics

By maintaining these habits, you support both immune strength and mental clarity over the long term.

Final Thoughts

Learning how to improve gut health for better immunity and mental clarity is one of the most impactful investments you can make in your overall health. The gut influences nearly every system in the body, from immune defense to cognitive performance.

By nourishing your gut with the right foods, managing stress, and adopting healthy daily routines, you can build a stronger immune system and experience clearer thinking, improved mood, and greater resilience in everyday life.